The German stock corporations will distribute 75 billion in dividends, mainly in May 2023, and the DAX also rose to its new all-time high of 16,331 points in this month. In other words, May is really a stock market month! However, May is also repeatedly associated with the stock market wisdom “Sell in May and go away” (publicistic explanation*). However, if you look at scientific studies, such as the study “The Halloween indicator, “Sell in May and Go Away”: Everywhere and all the time” by Cherry Y. Zhang and Ben Jacobsen from 2021, the effect can be proven. However, the market performs on average only 1% worse between May and October than between November and April. Accordingly, I prefer not to devote myself to the well-known calendar anomaly, but to the dividend!

Table of Contents

ToggleWhether with or without Dividend, Investing Pays off in the Long Term

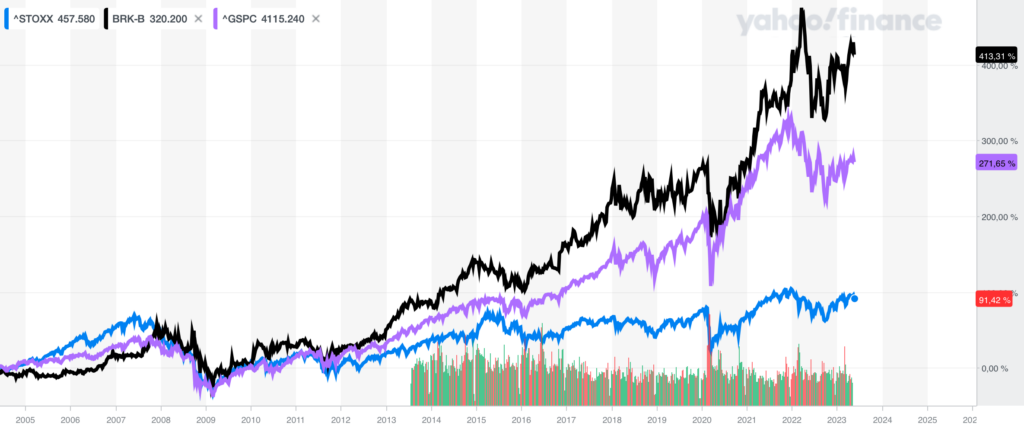

On May 6, 2023, the Annual General Meeting of Berkshire Hathaway took place again in Omaha. This is the investment company of investment legend Warren Buffett. The following chart illustrates why we are talking about a legend here: Warren Buffett repeatedly beats the market! However, investors are known not to receive a dividend.

STOXX Europe 600 (^STOXX) vs. Berkshire Hathaway (BRK-B) vs. S&P 500 (^GSPC)

Source: Image from yahoo! finance

The podcast episode “Three top stocks from Warren Buffett” reports on the success of Warren Buffett. For private investors, however, it becomes particularly exciting from the 28th minute, because this is mainly about Apple and the contrary opinions of the experts Christian Röhl and Tobias Kramer about individual positions in the Berkshire Hathaway portfolio.

The discussion shows the risk of investments in individual stocks. Even if Berkshire Hathaway has certainly been a good investment in recent years, looking at the chart above, this does not necessarily mean that this will continue to be the case in the future. Because even the experts are often not in agreement when it comes to individual stocks … While one is still convinced of the company, the other is considering an exit. Here I would like to refer again to my post “Chat GPT in investment”, where I discussed the individual analysis of a single stock.

Dividend Stocks are an Insecure Passive Investment

“Earning money passively” is often found in posts on Instagram & Co. The slogan sounds promising at first and the way we all imagine it – doing nothing and earning money. The reality here is actually a little different, because even the investment in a dividend title is an investment that I have to or should take care of occasionally. Christian Röhl will impressively show that this is not a full-time job in his new book “Stay cool and collect more dividends*” after the first edition was a complete success.

Post on Instagram about passive income with dividends

Source: dividendenpacker on Instagram

Although the new book will not be published until later, you can already see in Christian Röhl’s “Dividend Study 2023” from page 16 that the previous performance is no indication for the future. Here are the defaults of dividend payers from the real estate industry.

Dividend Yield as the Sole Indicator is Controversial

The dividend yield is a frequently used indicator in practice, but there is no reliability here either. This is also shown by the study “International evidence on stock returns and dividend growth predictability using dividend yields” by Ana Monteiro, Helder Sebastião and Nuno Silva from 2020. Here it becomes particularly clear that certain effects only apply to certain stock markets and not across the board.

The study “Exploiting the dividend month premium: evidence from Germany” by Felix Kreidl and Hendrik Scholz shows, however, that dividends lead to abnormal returns in the market. This is especially the case for the period between announcement and ex-date.

Own Research on the Topic …

In the article “Empirical determination of a safe withdrawal rate for diversified pension portfolios taking into account historical returns and inflation rates”, Alexander Dziwisch and Philippe Krahnhof and I dealt with the question of how to sensibly dissave your bulging portfolio in old age. The article from the journal for the entire insurance science shows that a strategy is also important when it comes to dissaving. The dividend should certainly be taken into account when building up assets, but then not simply squandered in old age.

That’s Coming …

May is followed by June, which for me will be in the context of Finfluencers. I am curious to see how the discussion will go and what impulses I will also receive for my content here.

*Affiliate Link / Advertisement